real estate tax shelter example

It is true if you plan to use deductions as a tax shelter. These three real estate tax shelters bring in big savings for the wealthy.

What Is The Biggest Tax Shelter For Most Taxpayers

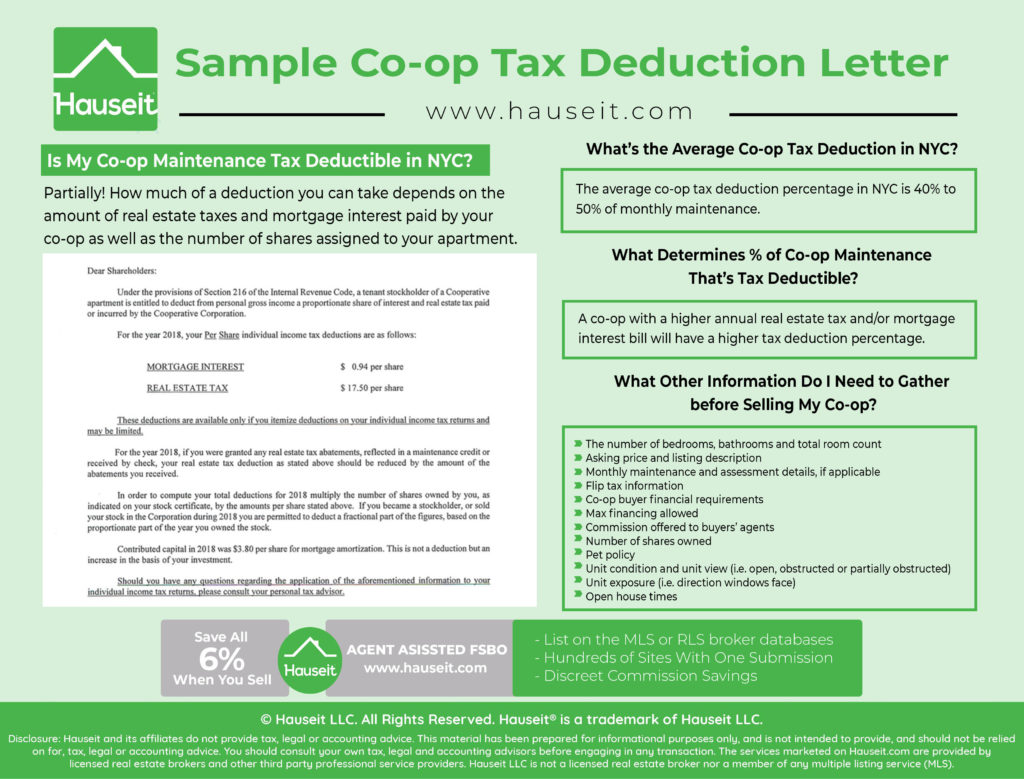

Purchasing real estate is another way to set up a tax shelter because you can claim several deductions that renters cannot.

. A tax shelter is among other things any investment that has a tax shelter ratio exceeding 2 to 1. Although there are a few legal ways to minimize your taxes sheltering is one of the easiest methods to use by making for example pre-tax contributions to tax shelters reducing your taxable income and thereby reducing your tax liabilities. When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have several repair bills among other things.

Jim Harbaugh head coach of the University of Michigan football team is a prime example of someone who leveraged workplace benefits as a tax shelter Murray says. Streamlined Document Workflows for Any Industry. Two of the biggest tax deductions are mortgage interest and depreciation.

Using Deductions as a Tax Shelter. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b. And you also email your.

Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. These are cash losses. These options however can only become available once your itemized deductions surpass the IRS standard deduction.

In this article well take a look at how investors can calculate a baseline tax shelter on their real property assets. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. A step-up in basis is another instrument that provides tax shelter although not directly to the initial investor.

YOUR TAX SHELTER The tax advantages of owning your own home. In other words you are having to put money into the investment to keep it floating. Purchasing real estate can give homeowners several tax-shelter options not provided to their renting counterparts.

You run a home business from a spare bedroom. If you own investment real estate you may report an annual loss for tax purposes. If you earn 20000 annually for example and utilize tax shelters worth 5000 your taxable income reduces to 15000.

Real Estate. The IRS allows you to deduct qualified expenses related to owning a home including real estate taxes home mortgage interest and mortgage insurance premiums. The Tax Court has consistently disallowed losses deductions and credits from transactions it deems to be tax shelters.

Sometimes in order to save money you must spend money. A tax shelter is an investment or a business through which a taxpayer reduces his or her tax liability. That is what real estate tax shelters are for.

Creating a Real Tax Shelter. Find Forms for Your Industry in Minutes. Form 1099-INT and 1099-OID.

The numbers listed below are annual. N Real estate taxes paid n Moving expenses Financial Assets n Interest income statements. For example an investor purchases land for 2000 an acre.

Common examples of tax shelter are employer-sponsored 401k retirement plans and municipal bonds. Many practices that fall within this definition are perfectly legitimate for example investing in real estate trusts and pension plans. Ad State-specific Legal Forms Form Packages for Investing Services.

You should always consult with a professional but for a general overview check out A Beginners Guide Real Estate Tax Deductions Commercial vs. Key Takeaways A tax shelter is a place to legally store assets so that current or future tax. To see how a real estate tax shelter works lets go through an example using a 250000 property that generates 2000mo in revenue.

Historically real estate has proved to be a significant tax shelter. So the investor has 5000 spendable cash in. To be a tax shelter the investment has to lose money.

May 16 2013 More in. A traditional individual retirement account IRA is another example of a tax shelter and works in nearly the same way as a 401k account. Kim Kyung-HoonReutersFile A farm tractor hoes a field at a farm in Gaocheng Hebei province China September 30 2015.

However when a tax shelter is designed solely for tax avoidance it may be deemed inappropriate. The tax shelter ratio is the aggregate amount of deductions to the amount invested.

Income Tax Calculation For Professional Cricketer 1 5 Cr Husband And Wife Income Tax Budgeting Income

How To Avoid Estate Taxes With A Trust

California Property Investment Tax Breaks

Income Tax Deferral Strategies For Real Estate Investors

Exploring The Estate Tax Part 2 Journal Of Accountancy

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax Shelters Definition Types Examples Of Tax Shelter

What Is The Biggest Tax Shelter For Most Taxpayers

How Is A Tax Shelter Calculated In Real Estate

Is Now The Time To Consider A Real Estate Rental Property Tax Pro Plus

How You Can Make Money From Your Rental And Show A Loss On Your Tax Return Semi Retired Md

Tax Listings Personal Property Dare County Nc

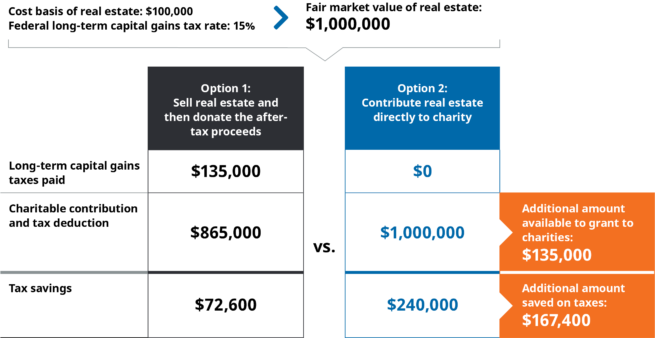

Benefits Of Donating Real Estate Directly To Charity

In Kind Donation Form Template Best Of 40 Donation Receipt Templates Letters Goodwill Non Profit Receipt Template Donation Letter Letter Templates

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Assignment Joint Ownership With Right Of Survivorship0004 Real Estate Forms Legal Forms Free Lettering

Top Tax Deductions For Second Home Owners

Real Estate Tax Invoice Template Google Docs Google Sheets Excel Word Template Net Invoice Template Estate Tax Google Sheets